Does Wyoming Have Homestead Exemption . while state homestead laws can be vary quite a bit, wyoming’s homestead exemption is not one of the more generous. Other states, such as new jersey and pennsylvania do not offer any homestead protection. the land can’t exceed more than 40 acres. Some states, such as florida, iowa, kansas, oklahoma, south dakota and texas have provisions, if followed properly, allowing 100% of the equity to be protected. wyoming law provides a homestead exemption that is a set monetary value of a homestead that is exempt from execution or. the state of wyoming currently has three property tax relief/credit/deferral programs available. If you sell your homestead, the exemption protects the proceeds for a maximum of two years. The homestead may consist of a house on a lot or lots or other lands of any number of acres, or. 66 rows state, federal and territorial homestead exemption statutes vary. The state excludes certain liens.

from www.slideshare.net

66 rows state, federal and territorial homestead exemption statutes vary. Some states, such as florida, iowa, kansas, oklahoma, south dakota and texas have provisions, if followed properly, allowing 100% of the equity to be protected. The state excludes certain liens. wyoming law provides a homestead exemption that is a set monetary value of a homestead that is exempt from execution or. the land can’t exceed more than 40 acres. Other states, such as new jersey and pennsylvania do not offer any homestead protection. the state of wyoming currently has three property tax relief/credit/deferral programs available. The homestead may consist of a house on a lot or lots or other lands of any number of acres, or. If you sell your homestead, the exemption protects the proceeds for a maximum of two years. while state homestead laws can be vary quite a bit, wyoming’s homestead exemption is not one of the more generous.

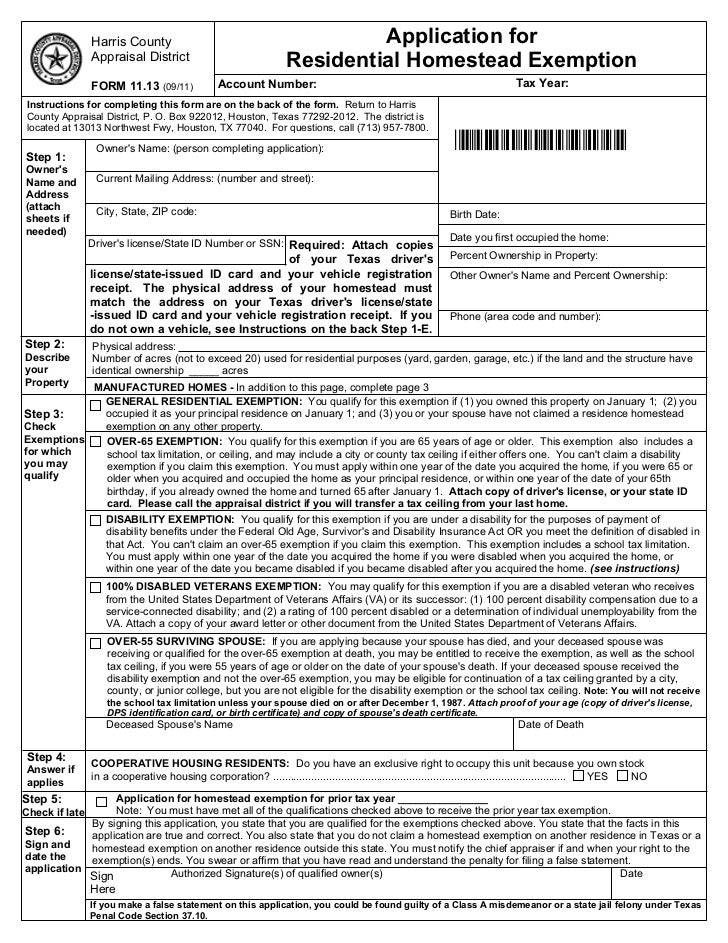

Homestead exemption form

Does Wyoming Have Homestead Exemption If you sell your homestead, the exemption protects the proceeds for a maximum of two years. wyoming law provides a homestead exemption that is a set monetary value of a homestead that is exempt from execution or. the state of wyoming currently has three property tax relief/credit/deferral programs available. The state excludes certain liens. Other states, such as new jersey and pennsylvania do not offer any homestead protection. 66 rows state, federal and territorial homestead exemption statutes vary. the land can’t exceed more than 40 acres. The homestead may consist of a house on a lot or lots or other lands of any number of acres, or. while state homestead laws can be vary quite a bit, wyoming’s homestead exemption is not one of the more generous. Some states, such as florida, iowa, kansas, oklahoma, south dakota and texas have provisions, if followed properly, allowing 100% of the equity to be protected. If you sell your homestead, the exemption protects the proceeds for a maximum of two years.

From issuu.com

Homestead Exemption Form Fort Bend County by REMAX Integrity Issuu Does Wyoming Have Homestead Exemption Other states, such as new jersey and pennsylvania do not offer any homestead protection. If you sell your homestead, the exemption protects the proceeds for a maximum of two years. the land can’t exceed more than 40 acres. 66 rows state, federal and territorial homestead exemption statutes vary. The homestead may consist of a house on a lot. Does Wyoming Have Homestead Exemption.

From www.exemptform.com

Example Of Homestead Declaration Certify Letter Does Wyoming Have Homestead Exemption The homestead may consist of a house on a lot or lots or other lands of any number of acres, or. 66 rows state, federal and territorial homestead exemption statutes vary. The state excludes certain liens. the state of wyoming currently has three property tax relief/credit/deferral programs available. while state homestead laws can be vary quite a. Does Wyoming Have Homestead Exemption.

From www.formsbank.com

Fillable Application For General Homestead Exemption printable pdf download Does Wyoming Have Homestead Exemption while state homestead laws can be vary quite a bit, wyoming’s homestead exemption is not one of the more generous. wyoming law provides a homestead exemption that is a set monetary value of a homestead that is exempt from execution or. If you sell your homestead, the exemption protects the proceeds for a maximum of two years. The. Does Wyoming Have Homestead Exemption.

From materialzoneandy.z13.web.core.windows.net

What Does Exemption Mean On W4 Does Wyoming Have Homestead Exemption the state of wyoming currently has three property tax relief/credit/deferral programs available. Some states, such as florida, iowa, kansas, oklahoma, south dakota and texas have provisions, if followed properly, allowing 100% of the equity to be protected. while state homestead laws can be vary quite a bit, wyoming’s homestead exemption is not one of the more generous. The. Does Wyoming Have Homestead Exemption.

From www.nps.gov

Homesteading by the Numbers Homestead National Historical Park (U.S Does Wyoming Have Homestead Exemption Some states, such as florida, iowa, kansas, oklahoma, south dakota and texas have provisions, if followed properly, allowing 100% of the equity to be protected. Other states, such as new jersey and pennsylvania do not offer any homestead protection. The homestead may consist of a house on a lot or lots or other lands of any number of acres, or.. Does Wyoming Have Homestead Exemption.

From www.tffn.net

Understanding Homestead Exemption How Does It Work and How Can It Save Does Wyoming Have Homestead Exemption 66 rows state, federal and territorial homestead exemption statutes vary. The state excludes certain liens. The homestead may consist of a house on a lot or lots or other lands of any number of acres, or. Some states, such as florida, iowa, kansas, oklahoma, south dakota and texas have provisions, if followed properly, allowing 100% of the equity to. Does Wyoming Have Homestead Exemption.

From www.har.com

Homestead Exemption Information Does Wyoming Have Homestead Exemption the land can’t exceed more than 40 acres. The homestead may consist of a house on a lot or lots or other lands of any number of acres, or. Some states, such as florida, iowa, kansas, oklahoma, south dakota and texas have provisions, if followed properly, allowing 100% of the equity to be protected. Other states, such as new. Does Wyoming Have Homestead Exemption.

From support.wcad.org

Homestead Exemption vs Homestead Designation Does Wyoming Have Homestead Exemption The homestead may consist of a house on a lot or lots or other lands of any number of acres, or. Other states, such as new jersey and pennsylvania do not offer any homestead protection. wyoming law provides a homestead exemption that is a set monetary value of a homestead that is exempt from execution or. If you sell. Does Wyoming Have Homestead Exemption.

From www.youtube.com

Time to Double Check your Homestead Exemption YouTube Does Wyoming Have Homestead Exemption Some states, such as florida, iowa, kansas, oklahoma, south dakota and texas have provisions, if followed properly, allowing 100% of the equity to be protected. The homestead may consist of a house on a lot or lots or other lands of any number of acres, or. The state excludes certain liens. while state homestead laws can be vary quite. Does Wyoming Have Homestead Exemption.

From cedarparktxliving.com

Texas Homestead Tax Exemption Cedar Park Texas Living Does Wyoming Have Homestead Exemption the land can’t exceed more than 40 acres. If you sell your homestead, the exemption protects the proceeds for a maximum of two years. Some states, such as florida, iowa, kansas, oklahoma, south dakota and texas have provisions, if followed properly, allowing 100% of the equity to be protected. Other states, such as new jersey and pennsylvania do not. Does Wyoming Have Homestead Exemption.

From www.vrogue.co

Homestead Exemption Form Fill Out And Sign Printable vrogue.co Does Wyoming Have Homestead Exemption The state excludes certain liens. Some states, such as florida, iowa, kansas, oklahoma, south dakota and texas have provisions, if followed properly, allowing 100% of the equity to be protected. Other states, such as new jersey and pennsylvania do not offer any homestead protection. If you sell your homestead, the exemption protects the proceeds for a maximum of two years.. Does Wyoming Have Homestead Exemption.

From hellohomestead.com

How to start homesteading in Wyoming Hello Homestead Does Wyoming Have Homestead Exemption The homestead may consist of a house on a lot or lots or other lands of any number of acres, or. 66 rows state, federal and territorial homestead exemption statutes vary. the state of wyoming currently has three property tax relief/credit/deferral programs available. wyoming law provides a homestead exemption that is a set monetary value of a. Does Wyoming Have Homestead Exemption.

From www.talkovlaw.com

Homestead Exemption California The Ultimate Guide Talkov Law Does Wyoming Have Homestead Exemption wyoming law provides a homestead exemption that is a set monetary value of a homestead that is exempt from execution or. while state homestead laws can be vary quite a bit, wyoming’s homestead exemption is not one of the more generous. The homestead may consist of a house on a lot or lots or other lands of any. Does Wyoming Have Homestead Exemption.

From www.exemptform.com

Henry County Homestead Exemption Form Does Wyoming Have Homestead Exemption 66 rows state, federal and territorial homestead exemption statutes vary. the state of wyoming currently has three property tax relief/credit/deferral programs available. Other states, such as new jersey and pennsylvania do not offer any homestead protection. while state homestead laws can be vary quite a bit, wyoming’s homestead exemption is not one of the more generous. The. Does Wyoming Have Homestead Exemption.

From www.theprairiehomestead.com

homesteadinginwyoming • The Prairie Homestead Does Wyoming Have Homestead Exemption The state excludes certain liens. If you sell your homestead, the exemption protects the proceeds for a maximum of two years. Some states, such as florida, iowa, kansas, oklahoma, south dakota and texas have provisions, if followed properly, allowing 100% of the equity to be protected. while state homestead laws can be vary quite a bit, wyoming’s homestead exemption. Does Wyoming Have Homestead Exemption.

From yourrealtorforlifervictoriapeterson.com

Homestead Exemptions & What You Need to Know — Rachael V. Peterson Does Wyoming Have Homestead Exemption The state excludes certain liens. wyoming law provides a homestead exemption that is a set monetary value of a homestead that is exempt from execution or. 66 rows state, federal and territorial homestead exemption statutes vary. If you sell your homestead, the exemption protects the proceeds for a maximum of two years. The homestead may consist of a. Does Wyoming Have Homestead Exemption.

From welcomehometeamnaples.com

Homestead Exemption Home Team Naples Does Wyoming Have Homestead Exemption the state of wyoming currently has three property tax relief/credit/deferral programs available. the land can’t exceed more than 40 acres. The state excludes certain liens. Some states, such as florida, iowa, kansas, oklahoma, south dakota and texas have provisions, if followed properly, allowing 100% of the equity to be protected. while state homestead laws can be vary. Does Wyoming Have Homestead Exemption.

From www.slideserve.com

PPT Changes to the Homestead Exemption Program PowerPoint Does Wyoming Have Homestead Exemption The homestead may consist of a house on a lot or lots or other lands of any number of acres, or. Other states, such as new jersey and pennsylvania do not offer any homestead protection. Some states, such as florida, iowa, kansas, oklahoma, south dakota and texas have provisions, if followed properly, allowing 100% of the equity to be protected.. Does Wyoming Have Homestead Exemption.